Australia has been lucky over the last few decades since we’ve done well to dodge the worst of the global financial crisis and experienced strong economic growth. However recently, the media have begun hinting that we’re entering a recession.

The economic slowdown that’s happening both locally and globally, plus political upset and trade conflicts mean the top brass in businesses across Australia have expressed lowered confidence in the country’s growth prospects.

It’s not a matter of if the market will contract, it’s a matter of when.

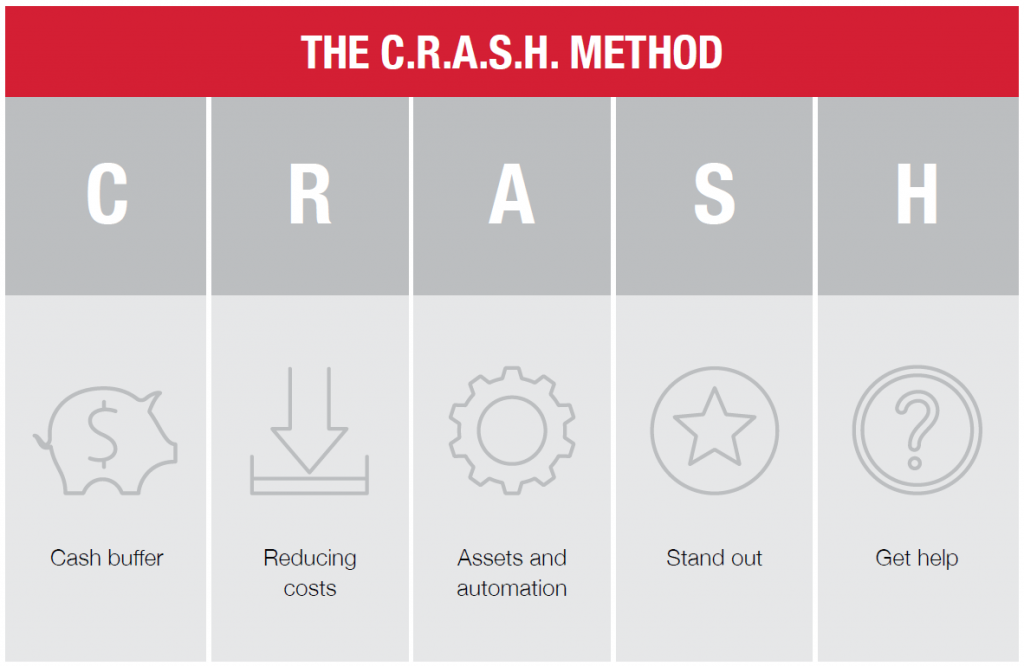

If tomorrow’s headlines screamed of disaster and consumer sentiment fell through the floor, what would happen to your business? Would you be worried or optimistic about the opportunities that were about to present themselves? Or worried about whether you would survive the C.R.A.S.H.?

This guide has been designed to help you prepare for worst case scenario even if it never happens.

The article covers the 5 steps to protect you against a market C.R.A.S.H. Not only will this guide help shield you when things go bad, but it will also give you a competitive edge when things are going well.

“Recession is opportunity in wolf’s clothing.”

– Robin Sharma

Step 1. Cash Buffer

Stockpiling cash is easier said than done. While this step seems painfully obvious, an ASIC report revealed that 40% of business failures are due to a lack of cash flow. A significant part of the problem stems from something called Parkinson’s Law.

Parkinson’s Law is the adage that “work expands to fill the time available for its completion”.

Have you ever noticed that if you have an hour to complete a task, it takes an hour? Whereas if you’ve only got five minutes, you somehow manage to get it done in that time? That’s Parkinson at work.

The concept also applies to your money. It’s important to recognise you (or your team) are likely to spend any cash that’s available.

As your business grows, and your cash accumulates, somehow, you will find new ways to spend that money. Of course, many of those new expenses are legitimate running costs of your growing business. However, upon closer examination, you will discover that much of the new spending is on non-core activities. Perhaps you decide to re-brand, even though there is no good reason to (other than the fact that you’ve got bored with the ‘look’ of your stationary). Perhaps you start getting a few more Uber Blacks, when before you were happy with the Uber X.

It’s easy to fall into this trap and fail to prioritise stockpiling cash for when it’s needed. One of the main problems is most small business owners have their money coming in and out of the same bank account.

“As sure as the spring will follow the winter, prosperity and economic growth will follow recession”

– Bo Bennett

This is like storing all your food on one plate—or constraining your time available to complete a task. The one account mistake is a recipe for consistent and never ending cash flow issues.

If this is how you’re currently running your business, you’ll never build it into something profitable. It is impossible to keep track and every windfall will be very quickly spent.

The fact is, if you pull some cash out (profit) and lock it away the moment it comes in, you will work out how to run your business on what’s left. You just will. (You probably started with nothing, and you managed to work it out). Surpluses tend to make us less creative and resourceful – so it’s best to squirrel some cash away right now, and get back to working out how to manage what’s left.

For a profitable business model, SIX is the magic number

To make sure your business is adequately prepared for a C.R.A.S.H., starting NOW, allocate your revenue into several smaller plates (i.e., bank accounts) instead of a single big one.

Six may seem like overkill but it makes it easier to keep track and also form habits. Each account has a separate purpose.

Business accounts: The magic six

Tip: Make it simple – visit your account every two weeks and redirect everything in your income into the other accounts.

Handling your business finances this way not only keeps you from overspending but also makes sure you always have enough money for both expected and unexpected expenses—all while still having extra cash to make a positive impact in the world.

Action stations: set up your accounts today

If you are not constraining yourself by allocating money to the important areas of saving, donating and yes, paying yourself, you will end up spending all your revenue. This may help grow your business faster but you are not protecting your business and you risk ending up in a place where you’re constantly chasing your tail, or worse.

Your challenge is to break Parkinson’s Law – Nature only evolves when it is forced to. Your business is the same. Taking the challenge to move away from your instinct to spend every dollar you have is an action you’ll never regret.

Read more: The 7 key causes of poor cashflow

Step 2. Reduce Costs

Proper allocation of your cash is just the first step. You also need to be able to significantly cut the amount that’s going out if you want to be fully prepared for a C.R.A.S.H.

This doesn’t mean you should be cheap for the sake of being cheap. The last thing you want is to minimise costs to the point where it negatively impacts your brand.

Spending less shouldn’t equal doing less. Don’t throw the baby out with bathwater and minimise costs to the point where you can’t run your business.

What you need to do is have a thorough understanding of every expense involved with running your business and figure out which of these expenses can be eliminated or at least reduced.

To do this, you need a three-step process:

- Identifying hotspots

- Prioritising which ones to make cuts to

- Incentivising the cuts

Identifying hotspots

To identify hotspot, you need to look out for these three things in your financials:

If you’re a one-man show, you can probably do this yourself with your accountant but depending on the size of your organisation, you might have to divide this task among all the different teams or departments in your company to make it easier.

Once that’s done, decide which ones belong to these three categories:

Anything that falls into the first category, of course, you can’t really touch – unless you figure out a way to make it more affordable without any negative repercussions. An example would be truck maintenance if you run a logistics company.

Items that fall into the second category can be manipulated to cost less. Think of the fridge in your break room. It is by no means critical to your business but if you remove it, people won’t be happy. Perhaps it would be wise to just switch out the fancy water bottles for a home brand variety.

Needless to say, anything that falls into the third category can go. An example would be mobile plans for people who never leave the office and don’t take work-related calls from home. You’ve probably got way more subscriptions to online tools and websites than you really use – It’s worth going through everything line by line.

Prioritising cost cuts

Before you decide which items to try and reduce the cost of, you have to do some prioritisation. Make this easy for yourself and your team by figuring out which items fall into which of the following categories:

Incentivising expense cuts

Nobody likes the thought of spending less, mostly because they think it means they’ll be missing out on something, so give your team a reason to care about reducing costs.

Firstly, be honest. If the business spends less, everybody gets to keep their jobs. This is a fundamental truth that’s often overlooked or understated. Working for a great company is a privilege so it’s often easier than you think to motivate your team to participate even without cash bonuses or incentives.

The next step is to build a culture of saving money in your organisation. You can do this by turning the whole thing into a game and having a weekly meeting where teams try to outdo one another in terms of how much money they save or are in the process of saving. The winner gets some kind of reward— which doesn’t have to be monetary.

The third and final step is to be transparent. Give your team access to the company’s financials so they can see for themselves the impact of whatever cost-cutting measures they’re implementing. They can keep score and see how the business is progressing as a way to stay motivated and look for even bigger cost-cutting opportunities.

Undertake expense reviews as frequently as four times per year so you know how much money is going out the door that doesn’t need to be.

Step 3. Assets And Automation

Now you have eliminated costs, your next step is to consider that you’re paying your people for their time, and time is expensive.

To ensure you’re getting the maximum returns from every dollar you spend, master the arts of both delegation and automation.

Your best, highest-paid people need to be free to work on the highest-impact tasks that generate revenue for your business.

When it comes to low-value tasks, delegate. Assign them to interns or junior team members so you can focus on other, more important areas.

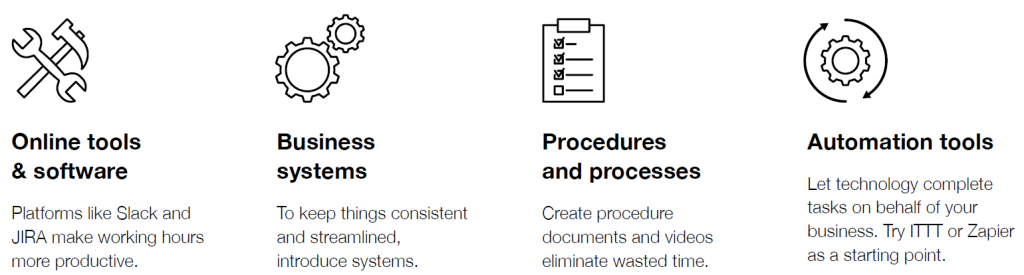

All about automation

Automation will cut out a lot of the noise from your business and help save you thousands. It’s not a task for you as the business owner: your team should be able to discover and implement automation that saves time and money.

Five things to automate:

- Customer response

- Sales & Marketing

- Meeting minutes

- Lead generation

- Scheduling meetings

All about assets

Basically, an asset is anything that continues to produce new value if you and your team were to disappear. Imagine for a moment looking at your business from a distance. Now, from that vantage point, imagine it without people. The degree to which things are still happening is the degree to which you have built an asset-driven business.

The right assets can make workflows faster, can automatically generate inbound leads, reduce the amount of time spent training a new team and have your business running like a well-oiled machine.

Each asset you invest in should provide a clear and measurable return on investment and reduce task loads.

Examples of assets

The goal of automation and assets

Often as businesses grow, they become more complex. There are more layers, more moving parts and more expenses.

By continually striving to eliminate expenses, delegate to junior staff and automate tasks, you’re creating a business that is not only successful but also efficient. Profits are high and running costs are minimised. There are systems in place so that if you’re not there or someone else is not there, the machine keeps running.

Recession-proof your business by running lean and getting the maximum return on every person you employ.

When the recession hits, instead of having a bloated, lumbering organisation with people who don’t really need to be there and money being drained where it doesn’t need to be, your business is already its best version of itself.

Do an exercise where you and your top players write out every repetitive, non-skilled task they do each week and how long it takes them. How much more would your business earn if they spent this time bringing in actual revenue? This is where having virtual assistants, who charge far lower rates, can act to propel your profits up a level.

Step 4. Standing Out

One of the fastest ways to create a breakthrough in your business is to be recognised as the ‘Go To’ brand in your industry- make a business that stands out

This goal of becoming highly visible and well respected in your field should not be overlooked. This positioning as an industry leader makes every other key activity in your business cheaper and more effective.

Imagine your brand was widely recognised as the #1 ‘Go To’ brand and you (the founder) were recognised as a Key Person of Influence in your industry. You and your company were regularly in the media and invited to speak at large scale conferences. What would happen to your cost per lead? How much easier would it be to attract top talent? Would you be able to land that key partnership faster? Of course you would.

Until you’re recognised as one of the ‘Go To’ brands in your industry, everything is more difficult and expensive.

Businesses led by founders who are well known, liked and trusted are much more resilient in a downturn because people know they’re the best.

Here are 5 things to focus on:

Perfect your pitch

When times are good, it’s easy to get a little lazy when it comes to making the most out of your communication and marketing. Your business ‘pitch’ is the essence of your value proposition. It should capture the attention, and interest of your target audience quickly, and powerfully. Spend time answering this question: “Why should someone choose to work with you over your competition?”

Publish thought leadership

Publishing content is a great way to reach more people and begin to generate ‘inbound’ opportunities. Establishing credibility by getting your message heard by those who matter to increase the growth of your business is key. However, the #1 reason we find why people don’t produce more content is a lack of time.

A good goal should be to produce enough content that if someone wanted to ‘content gorge’ on your material, it would take them more than 7 hours, and they would end up visiting at least 4 different platforms to do it.

For example, perhaps someone watches a recording of a 90-minute talk you gave on YouTube. Then they listen to a 2hr podcast episode. Then they spend an hour reading a variety of articles you’ve published. Of course, this doesn’t need to happen all at once—it can happen over time, however the magic number is 7 hours, across 4 platforms. That’s your target and if the market drops and opportunity dries up, you will have a much wider “net” than most to keep you busy with a steady stream of new business.

Build a product ecosystem

Single products and services don’t make money—product ecosystems do. There are 4 types of products every business needs to thrive.

Each product layer in your ecosystem must satisfy the following outcomes:

- A product that captures ATTENTION and creates a LEAD.

- A product that builds TRUST and creates a HOT LEAD.

- A product that solves a problem and creates REVENUE.

- A product that offers ongoing support and creates RECURRING PROFIT.

Without these 4 types of products, your business will lack the efficiency it needs to thrive as too much human time, which is expensive, will be required to achieve those outcomes.

Raise your profile

These days, you are who Google says you are. We encourage you to google yourself and your company right now and experience what comes up from the perspective of a prospect, a journalist or a potential major alliance partner.

Are you signalling authority and credibility? Now try Googling your competition. How are they doing? You will find yourself either having to seriously play catch up if you want to stay relevant over the next 3-5 years OR, you will find yourself with an opportunity to easily stand out from the crowd. Either way, there’s no time to lose.

Poor profile? Just add S.A.L.T.

There are 4 key areas you need to master. Ask yourself, are you worth your S.A.L.T. in your industry?

S = SOCIAL MEDIA

Yes, you’ve got to nail social. We recommend focusing on this step AFTER you’re rockin’ the next three steps.

A = AWARDS/ ACCOLADES

We were named the 9th fastest growing company in Australia (Award). We were named by Inc.com as “one of the world’s leading business accelerators” (Accolade). Make a list of awards / accolades that best suit your business.

L = LIVE APPEARANCES

Being invited to speak, judge, host or sponsor at a live industry event catering to your target market creates a real impact and boosts your credibility. Got a speakers kit? You should.

T = THIRD PARTY MEDIA

Getting yourself and your business in the media, on other peoples podcasts or blogs – anything where someone else is featuring you and the work you do.

Start with ALT, then circle back to S and you will find your results in social will be far better.

WARNING: Like salt, “personal branding” is something that should be added in small amounts to an existing “main course” of a successful business. On its own – it’s horrible.

Partnerships

Nothing great was ever achieved in isolation. One of the easiest ways to boost opportunity regardless of the market conditions is through creating joint ventures, partnerships and alliances with existing high performers in your industry.

Here are 3 types of partnerships to consider:

BRAND Partnerships. These types of partnerships align your brand with an individual or company brand that has more credibility in your industry than you do. For example, if you hosted a talk or webinar with a well-known celebrity, the association would transfer some of their brand goodwill to you. The same rings true for a partnership with a blue chip organisation or association.

PRODUCT Partnerships. These types of partnerships allow you to deliver more value to your customers without you having to build additional internal capacity. An accountant may establish a partnership with a mortgage broker, for example, creating better outcomes for the customer.

DISTRIBUTION Partnerships. These types of partnerships help you reach a wider audience. For example, a marketing company may promote the services of a great web developer to their database and vice versa. If there is no competitive overlap between the two partners, then this is an incredibly powerful way of driving a tonne of new business at no cost to either party. One of the most powerful tools for thriving in any market condition is through establishing a wide variety of distribution partnerships.

The key is to not start at one or two. If you have taken the time to work on each of the previous 4 steps, you will have a highly credible message, with a variety of great content and a product ecosystem that will help you create a wide variety of powerful partnerships.

Step 5. Help (Self & Others)

It’s essential to have a “circle” of suppliers and partners who can help you when times get tough. The key with this step however is deep diving into how YOU can help other people when times get tough.

What products or services can you create and deliver that would help others survive the C.R.A.S.H.? Being able to answer this question will help you position yourself in a way that will help you keep the cash coming. You can also use the situation not only to keep the cash coming in and cement yourself as an authority in your field.

Who does your business need?

Make a list of external providers/ partners who can help guide you through a downturn, including Accountants, Business Coaches, JV Partners for lead generation, Suppliers with flexible terms, Banks/Finance providers and anyone relevant to your business.

How can you help others?

Make a list of the ways you could help others through a recession.

Market crashes present massive opportunities to those who come in prepared. As early as right now, start marketing your products and services as something companies can use to either prepare for or weather the upcoming recession.

Hope is not an effective strategy for handling an economic downturn, nor is brute force sales and marketing.

If you’re not confident your business can weather a recession, the good news is all you have to do is get started. Take the first step by creating those additional accounts (or delegate the task to a junior—you’re busy after all).

Proper preparation prevents the probability of poverty!

The added bonus of recession-proofing your business means you’ll instantly start streamlining your operations and keeping more of the money you’re making.

When you have money during a recession, you have the power to grow your business significantly faster than when the market is doing well. Not only is everything so much cheaper, but you will also have top talent seeking your company because it offers a stable and steady income.

When the recession does hit, we can expect there to be carnage. But when the economic sun begins to shine again, those that have stood strong through the hard times will be able to hit the ground running faster than ever.

Find out how our team at KMT Partners can help you through these difficult times and reach out if you need any assistance.

Source: Dent Global

Read more: The 6 Most Recession-Proof Industries

This is general advice only and does not take into account your financial circumstances, needs and objectives. The article should not be relied upon as specific information or advice without obtaining appropriate professional advice after a detailed examination of your particular situation from a qualified KMT adviser.