In the complex landscape of business governance, success lies in a well-structured and thoughtful planning process.

Following the previous article about Understanding the importance of business governance, in this article, we will explore the essential steps, frameworks, and capabilities required to establish and maintain effective governance within organisations.

The planning process

The planning process serves as the foundation for robust governance practices. Here are the key steps to consider:

1. Assessing the business environment

Understanding the external factors that shape a business is vital. Economic, demographic, technological, social, political, legal, and ecological aspects must be carefully evaluated to gain insights into the broader landscape in which the organisation operates.

2. Market review and competitor analysis

In-depth market analysis and competitor evaluation enable businesses to identify opportunities and stay ahead of the competition.

A market review should include:

- Size, segment size, and growth rate

- Price sensitivity

- Service features

- Seasonability and demand distribution

- Supplier and customer price power

- Types of competition and entry to market cost

- Technology capability

- Intellectual capability

- Intellectual property capability

- Manufacturing process

- Innovation capability

A competitor analysis should include:

- The current known competitors, their objectives and strategies

- Potential new entrants and how they might differentiate

- Competitor strengths, unique propositions and their sustainability

- Weaknesses

3. Performance and capability analysis

Thoroughly analysing market positioning, financial strength, operational efficiency, management capabilities, and asset utilisation helps organisations understand their core competencies and areas for improvement. This assessment provides a solid foundation for strategic decision-making.

Analyse market positioning, including:

- In which market segments is the company strong?

- At what stage of the market life cycle are those segments?

- Is the company the leader in innovation (product or service)?

- To what extent can the company control its pricing?

- What core competencies does the company possess and are these sustainable?

Analyse financial positioning, including:

- What is the company’s cost of capital?

- What is the profile of free cashflow generation from core operating activities?

- What are the company’s forecast capital requirements?

- Is the asset backing adequate?

- Do exchange rate fluctuations impact the cost of sales or the value of exports?

- What expectations do shareholders have in terms of profit and dividends?

Analyse operational positioning, including:

- What is the company’s overall culture, morale and staff turnover?

- How connected is the team to the company’s purpose and strategy?

- What is the team’s capacity to adapt and change?

- What is the level of management capability throughout the organisation?

- What degree of obsolescence applies to the company’s plant, technology, and intellectual property?

4. Developing a company strategy

Crafting a well-defined company strategy aligns with the organization’s purpose, vision, and long-term goals. An effective strategic plan sets the roadmap for success and ensures the organization stays focused on its core objectives. Seeking professional assistance may be beneficial in creating a robust strategic plan.

5. Setting company objectives

Aligning objectives with the company’s purpose is paramount. With the company’s purpose understood, the Board needs to determine a Strategic Plan to implement that purpose.

A Strategic Plan normally takes a medium view (5 years) of the business. Smaller and less complex businesses need to have, at the very least, an annual Business Plan. The Business Plan will specify objectives over shorter periods, for example, a year or a quarter, against which results can be measured.

Objectives are often divided into three categories:

1. Recurring: These tend to be financial, marketing, or sales oriented.

2. Creative: These are required to strengthen the company’s longer-term position and profitability. For example, to develop new markets, to develop new products or services, or to increase penetration in existing markets.

3. Problem-solving: For example, fixing poorly performing departments, fixing product defects, reducing exposure to major customers, achieving productivity gains, reducing overheads, or releasing cashflow.

Building an effective governance framework

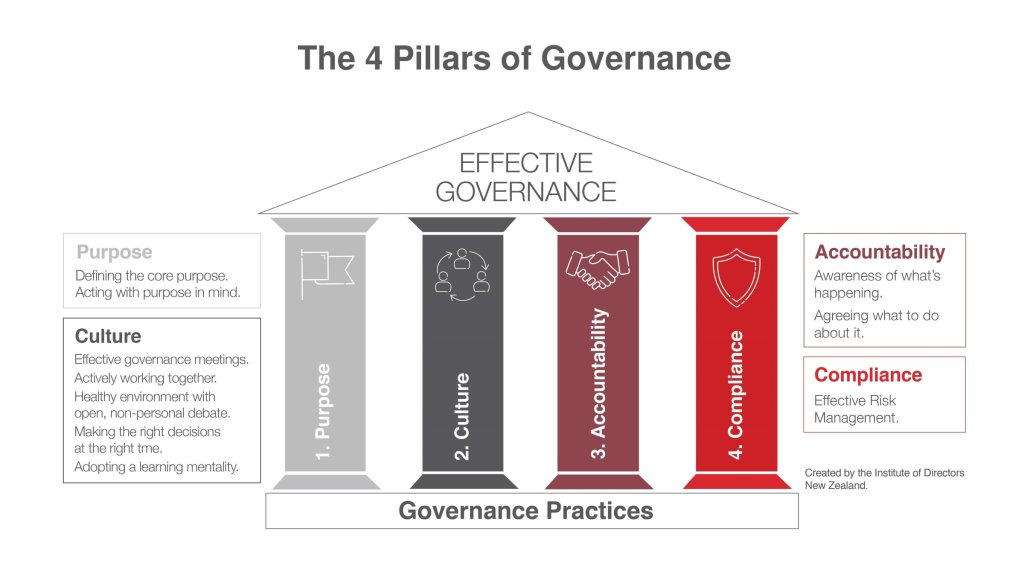

Establishing a strong governance framework forms the bedrock of effective governance practices. This framework revolves around four pillars:

- Purpose: Clearly defining the organisation’s core purpose, vision, and values sets the direction for governance efforts. A well-crafted strategic or business plan, governance action calendar, and succession plan further support the organisation’s purpose-driven governance approach.

- Culture: Cultivating a governance culture involves holding effective meetings, fostering open and non-personal debates, and ensuring robust decision-making processes. Clear board role descriptions, succession policies, and defined expectations of directors contribute to building an effective governance culture.

- Accountability: Creating mechanisms for accountability is essential. This includes implementing reporting policies, defining key performance indicators (KPIs), establishing budgeting and forecasting policies, and delegating authority appropriately. These practices ensure transparency, responsibility, and alignment with organisational goals.

- Compliance: Managing risks and complying with ethical and sustainability standards is critical. Robust risk identification, prioritisation, management processes, and clear policies on ethics, sustainability, and capitalisation decisions help organisations navigate potential challenges.

Mastering governance capabilities

Developing the following seven key governance capabilities empowers organisations to excel in their governance practices:

- Financial understanding: Understanding financial reports and key performance indicators (KPIs) enables informed decision-making, leading to sound financial management and strategic choices.

- Self and interpersonal awareness: Building self-awareness and understanding others’ strengths, motivators, and stressors fosters effective collaboration, communication, and relationship management.

- Focused planning: Mastering focused planning ensures that resources and efforts are directed towards activities that align with the organization’s long-term success, rather than being distracted by urgent but unimportant tasks.

- Directing in service of others: Effective governance requires directors to prioritise value creation for stakeholders, embracing servant leadership principles that inspire and align actions with the organisation’s purpose.

- Performance management: Empowering teams by setting outcome-based objectives and encouraging a solution-oriented approach enhances individual responsibility, accountability, and overall performance.

- Inspirational leadership: Leaders who can inspire teams by consistently connecting actions and decisions to the organisation’s purpose create a cohesive and motivated workforce.

- Teaching and learning: Promoting a culture of continuous learning and growth fosters personal and professional development, enhancing governance practices throughout the organisation.

Simplifying the governance framework

Implementing a governance framework should begin with recording essential practices, for example:

- Board Meeting standing agenda.

- Schedule of Board Meeting dates.

- List of reports the Board needs to be provided with in advance of each Board Meeting, including marketing and sales, financial, CEO or Managing Director.

Organisations can gradually expand their framework to meet specific needs and challenges.

An Advisory Board, which is a structured and collaborative method for organisations to engage with external advisers, can also provide sound advice and guidance to help businesses navigate complex or challenging scenarios, such as growth, expansion, change management, crises, sales, and problems.

Governance as a mindset

Achieving good governance extends beyond mere adherence to rules and procedures. It requires cultivating a mindset that prioritises well-governed practices and continuous improvement. Seeking professional guidance and embracing coaching and best practices can accelerate the development of a robust governance mindset.

Contact our trusted KMT advisers to develop your Governance Plan and implement best practices.

About our adviser: Michael Fox has been dedicated to the success of his clients, devising comprehensive wealth strategies for both personal and business growth for over four decades. With extensive expertise in business governance and family business succession, Michael specialises in empowering emerging businesses and family enterprises by fostering renewal, enhancing value and smooth transitions to the next generation. Please do not hesitate to reach out if you need assistance with governance planning.

Learn more about how we can help with Governance Planning services.

This is general advice only and does not take into account your financial circumstances, needs and objectives. The article should not be relied upon as specific information or advice without obtaining appropriate professional advice after a detailed examination of your particular situation from a qualified KMT adviser.