There has been a surge in ATO tax scams in recent years. These fraudulent schemes target unsuspecting individuals through various channels, including emails, phone calls, and text messages.

Let’s explore some common scams and learn how to protect yourself.

Tax Scam 1: Refund hoax

Scammers often send ATO-branded emails prompting recipients to click on links for supposed tax refunds. One prevalent example uses the phrase “You are due to receive an ATO Direct refund”.

The ATO will never send SMS or emails with links to access online services. Always access ATO services directly through ato.gov.au.

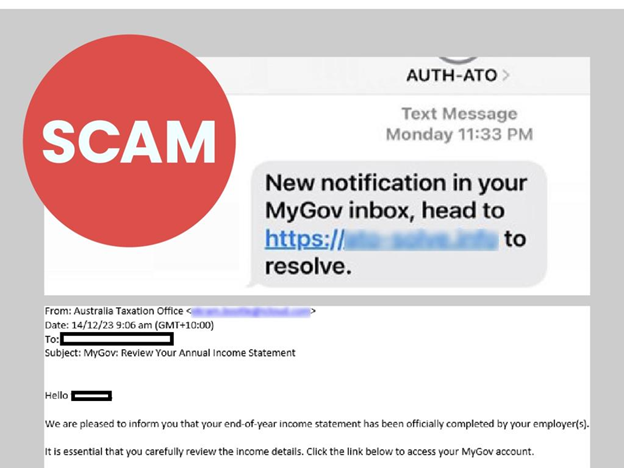

Tax Scam 2: Fake myGov emails

A heartless scam targeting myGov users has been doing the rounds, prompting a warning from the ATO and Services Australia for the public to be aware of scammers impersonating government agencies.

Scammers sent ATO-branded emails to users telling them: “You have a new message in your myGov inbox – click here to view”.

Tax Scam 3: Multi factor authentication email scams

The ATO has also reported an increase in reports of scammers impersonating the ATO and emailing the public to falsely advise them of security updates that require an update to the multifactor authentication on a person’s ATO account.

The scam email includes a QR code which takes the user to a fake myGov sign in page, designed to steal their myGov sign in details.

The ATO would never send an email with a QR code or a link to log in to online services.

Tax Scam 4: Tax time SMS and email scams

The ATO has previously warned to tax time ATO SMS and email scams. Scammers use different phrases to try and trick recipients into opening the dodgy links, such as:

“You are due to receive an ATO Direct refund”

“You have an ATO notification”

“You need to update your details to allow your Tax return to be processed”

“We need to verify your incoming tax deposit”

“ATO Refund failed due to incorrect BSB/Account number”

“Due to receive a refund, click here to receive a rebate”

Tax Scam 5: Social media account scams

Scammers have also created fake social media accounts impersonating the ATO across Facebook, Twitter, TikTok, Instagram and other platforms.

These fake accounts ask users to send them a direct message so they can help with their ATO query in a bid to steal personal details including phone numbers, email addresses and bank account information.

The ATO’s only official accounts are on Facebook, X and LinkedIn. They urged the public to only follow their verified accounts and to make sure any email addresses provided end with ‘.gov.au’.

Protecting yourself from tax scams

Always be cautious about sharing personal information. Scammers can use this data to access bank accounts and commit fraud in your name. Never share sensitive details like myGov login credentials, Tax File Numbers, or bank account information.

What should you do if you get scammed?

If you suspect your personal information has been compromised, call the ATO immediately on 1800 467 033. They’ll investigate and place additional protection on your ATO account.

For privacy reasons, the ATO may not leave a message unless your voicemail clearly identifies who you are.

How does the ATO contact you?

It’s crucial to remember that the ATO will never:

- Send texts or emails with links to services

- Ask for your tax file number or bank details via email, SMS, or social media

Stay informed and seek help!

By staying aware of these scams and knowing how the ATO operates, you can better protect yourself from falling victim to these fraudulent schemes. If you’re ever unsure about a communication claiming to be from the ATO, it’s always best to contact them directly through official channels.

Please feel free to contact us if you need tax assistance. Our expert accounting team is here to help you!

About our advisers:

Michael Fox has been dedicated to his clients’ success, devising comprehensive wealth strategies for personal and business growth for over four decades. With extensive expertise in business governance and family business succession, Michael specialises in empowering emerging businesses and family enterprises by fostering renewal, enhancing value, and smoothing transitions to the next generation. Please do not hesitate to reach out if you need assistance.

Chrisanthe Lekatis is renowned for her expertise in management accounting, virtual CFO services, and top-tier business advice. She empowers management with tailored strategies for success, streamlining processes to achieve efficient and cost-effective outcomes. Her commitment to building trust and lasting relationships goes beyond professional excellence; it’s a personal ethos. By actively listening and understanding her clients’ businesses and goals, Chrisanthe thrives on collaborative efforts to navigate challenges and collectively achieve their aspirations. Please do not hesitate to reach out if you need assistance.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or seek tax advice from a qualified accountant at KMT Partners. Information is current at the date of issue and may change.