With summer and Christmas just around the corner, you may be planning a party or similar event (e.g. a bowls day) for your employees.

The ATO has reminded employers to make sure they consider the fringe benefits tax (FBT) implications of the party or other event.

These will depend on:

- The amount you spend on each employee;

- When and where the event is held;

- The value and type of gifts you provide; and

- Who attends – is it just employees, or are partners, clients or suppliers also invited?

Don’t forget to keep all records relating to the entertainment-related fringe benefits you provide, including how you worked out the taxable value of benefits.

It’s important to get on top of how FBT works before you provide perks and extras, otherwise you may end up with an unexpected FBT liability.

Check out the fringe benefits tax and entertainment for non-profit organisations

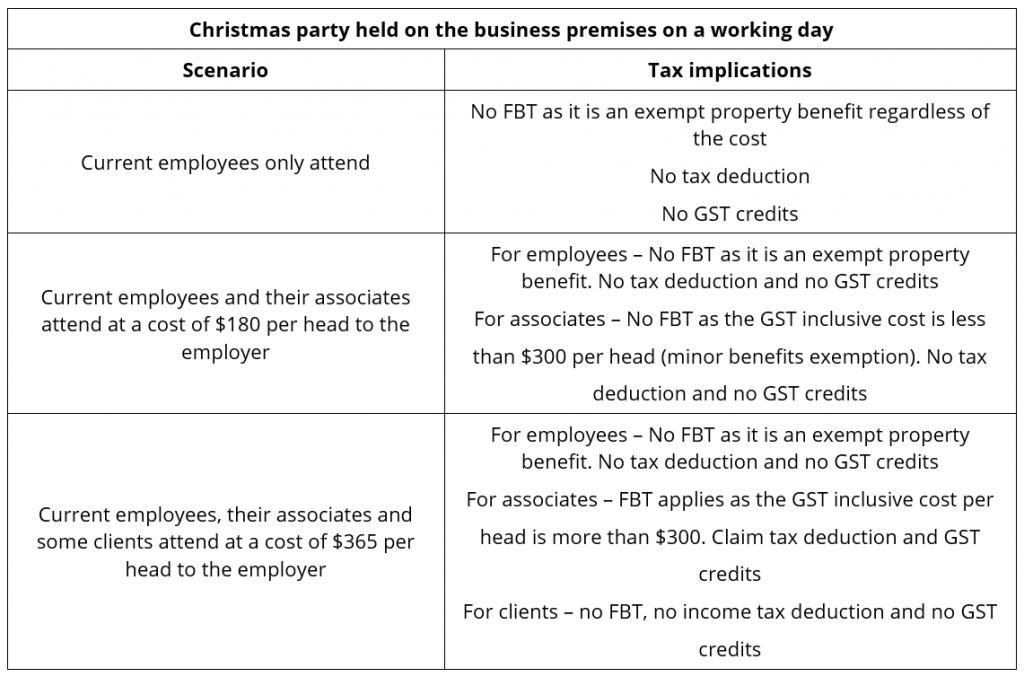

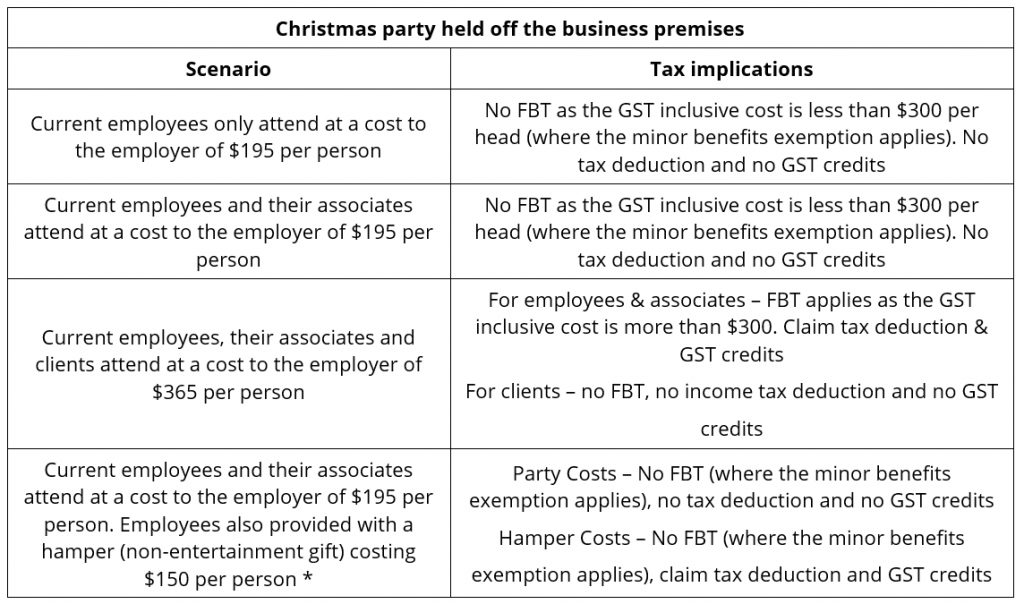

This article examines the tax implications of holding a Christmas party (on the business premises or off-site) and also providing employees (including working directors) and contractors with Christmas gifts.

An assumption in the examples provided below is that the business has not elected to use either the ‘50-50 split’ or ‘12 week register’ methods for FBT purposes.

Christmas parties

Christmas parties constitute “entertainment benefits” and to the extent that the expenditure relates to employees or their associates attending the function, the expenses may be subject to fringe benefits tax (FBT) unless an exemption (e.g. the “minor benefits” exemption) applies.

A minor benefit is one that is provided to an employee or their associate (e.g. spouse) on an “infrequent” or “irregular” basis, which is not a reward for services, and at a cost less than $300 (inclusive of GST) “per benefit”.

Entertainment expenses are not tax-deductible unless they are subject to FBT. This means that expenses incurred in providing a Christmas party are not generally deductible where the minor benefit FBT exemption applies.

* Non-entertainment benefits provided to employees at the Christmas party, such as a hamper, are considered separately when applying for the $300 minor benefits exemption. Although the total cost per person is more than $300, each benefit should be considered separately under the minor benefits exemption.

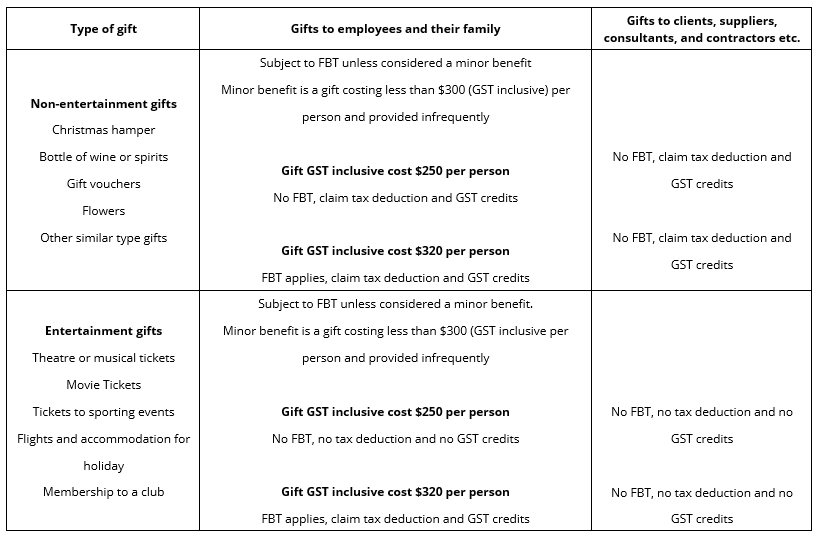

Provision of gifts

Generally, it is considered that the best tax outcome for businesses is to give employees non-entertainment type gifts that cost less than $300 (inclusive of GST) per employee as the cost is fully tax-deductible, with no FBT payable and GST credits can be claimed. The gifts at Christmas parties are usually exempt from FBT because they are not provided on a frequent or regular basis, and the gift is not provided to the employees wholly or principally as a reward for their services rendered.

Unlike non-entertainment gifts, gifts classified as entertainment, including recreation, are non-deductible and GST credits cannot be claimed. A tax deduction and GST credits can only be claimed on entertainment or recreation gifts where Fringe Benefit Tax applies. This means that while the minor and infrequent exemption could still apply for entertainment and recreation gifts costing less than $300 (GST inclusive), tax deductions and GST credits can only be claimed where FBT applies to entertainment and recreation gifts.

Talk to our KMT tax adviser to discuss any FBT implications.

About our adviser: Chrisanthe Lekatis is renowned for her expertise in management accounting, virtual CFO services, and top-tier business advice. Chrisanthe’s passion lies in process improvement, as she combines her analytical prowess with adaptability to explore avenues for business sustainability. By deeply understanding her clients’ businesses and goals, Chrisanthe empowers management with tailored strategies for success, streamlining processes to achieve efficient and cost-effective outcomes. Please do not hesitate to reach out if you need assistance.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or professional advice from your accountants at KMT Partners.