You may have heard or read about the new Director identification number (commonly referred to as DIN or Director ID – these terms seem to be quite interchangeable!). So, what exactly is a DIN or Director ID, who needs one and when are you required to apply?

Some background

As part of the Digital Business Plan announced in the Federal Budget 2020–21, the Federal Government announced the full implementation of the Modernising Business Registers (MBR) Program. This program unifies the Australian Business Register and 31 business registers administered by ASIC into a single platform and introduces the DIN initiative.

The Australian Business Registry Services (ABRS) – a newly established function of the ATO – will administer the platform and deliver its initiatives.

What is the purpose of DINs?

DINs are intended to prevent the use of false and fraudulent director identities and make it easier for external administrators and regulators to trace directors’ relationships with companies over time.

DINs also help detect and eliminate director involvement in illegal phoenixing activities. Illegal phoenixing activity is when a company is liquidated, wound up or abandoned to avoid paying its debts. A new company is then started to continue the same business activities without the debt.

What is a DIN?

A DIN is a unique 15-digit identifier given to a director who has verified their identity with the ABRS.

If you are a director, here are some things to note:

- You need to apply for your own DIN;

- It is free to apply and you will only need to apply once;

- You will have your DIN for life, even if you change companies, stop being a director or move countries.

Who needs a DIN?

You will need a DIN if you are a director or an alternate director (acting in that capacity) of:

- A company, a registered Australian body or a registered foreign company under the Corporations Act 2001 (Corporations Act). This includes the director of the corporate trustee of a self-managed superannuation fund (SMSF);

- An Aboriginal and Torres Strait Islander corporation registered under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act).

- If you are a director, you must apply for your own DIN because you will need to verify your identity. No one else can apply on your behalf.

To check if a director ID is required, you can search ABN Lookup with the ABN or business name. If an ASIC Registration — ACN or ARBN or ARSN or ARFN — is showing against the record, the director of the company will need to apply for a director ID.

Who doesn’t need a DIN?

You don’t need a DIN if you are:

- A company secretary but not a director;

- Running a business as a sole trader or partnership;

- Referred to as a ‘director’ in your job title but have not been appointed as a director under the Corporations Act or the CATSI Act;

- A director of a registered charity with an organisation type that is not registered with ASIC to operate throughout Australia;

- An officer of an unincorporated association, cooperative or incorporated association established under state or territory legislation, unless the organisation is also a registered Australian body.

When to apply

You will be able to apply for a DIN from November 2021 on the new ABRS website.

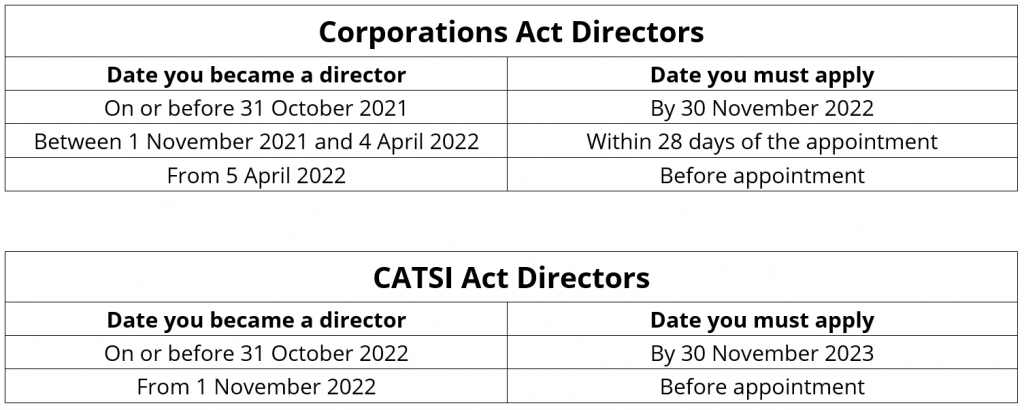

For Corporations Act directors, when you must apply depends on when you were appointed as a director for the first time:

- New directors appointed for the first time between 1 November 2021 and 4 April 2022 must apply within 28 days of their appointment.

- From 5 April 2022, intending new directors must apply before being appointed.

- Directors appointed on or before 31 October 2021 have until 30 November 2022 to apply.

Summary table:

How to apply

The easiest way to apply for a DIN is to do so electronically using the myGovID app (this is different to the myGov app), but telephone and paper alternatives will also be available.

Step 1 – Set up myGovID

Learn how to set up myGovID

Step 2 – Gather your documents

You will need to have some information the ATO knows about you when you apply for your director ID:

- Your tax file number (TFN)

- Your residential address as held by the ATO

- Information from two documents to verify your identity.

Examples of the documents you can use to verify your identity include:

- Bank account details

- An ATO notice of assessment

- Super account details

- A dividend statement

- A Centrelink payment summary

- A PAYG payment summary

Step 3 – Complete your application

Once you have a myGovID with a Standard or Strong identity strength, and information to verify your identity, you can log in and apply for your director ID. The application process should take less than 5 minutes.

If you currently reside outside Australia, you can apply using a paper application form – Application for a director identification number (NAT 75329, PDF 306KB).

In addition to completing the form, you’ll also need to provide certified copies of your documents that verify your identify. Do not send the originals as they will not be returned.

If you are having issues using the form, you can find help on the Accessibility page.

It is a criminal offence to not obtain your Director ID on time and penalties will apply. ASIC is responsible for administering the scheme under the Corporations Act.