So you want to improve the profitability of your business but don’t know where to start?

In this first blog of our ‘Profit Improvement Strategy’ series, our aim is to explain the basics to you and let you know what you need to address in order to increase the profit generated by your business and the money your business puts in your pocket. So read on!

What is a profit?

Profit is whatever is left over after you have paid all of your expenses.

Four factors determine your business profit:

- The price you charge for the products or services

- The quantity (or volume), of products or services

- The costs that you incur directly in producing or buying the products or services. These are known as variable costs as they can go up and down with your sales volume. A good example of this is the cost of raw material.

- The costs that you incur whether or not you make any sales. These are known as fixed costs because they do not change with your sales volume. A good example of this is the rent expense.

Suppose you sell one product called a widget for $100. You pay $60 for producing each widget.

What you sell the widget for is the price and what you pay to have it available for sale is the variable cost.

If you sell 100 widgets, your total variable costs are $6000. If you sell 50 widgets, your total variable costs are $3000. So, as you can see, your variable costs change with your sales volume.

If you sell a widget for $100 and it costs you $60 you have made a profit of $40 on each sale. This is called your gross profit or gross margin. Your gross profit gives you the resources to pay your fixed costs such as rent, wages, insurance.

Gross Profit – Fixed Costs = Net Profit

When you look at a set of financial statements, they tell the story of your business performance over the designated period.

- If you are in sales or manufacturing, the first item shown is sales less your variable costs (purchases, cost of sales), resulting in your gross profit. (Trading Statement)

- Fixed costs and general expenses are listed and calculated. The fixed cost total is then subtracted from the gross/ trading profit to give your net profit amount. This is the profit from your business that is cash available for you to spend on business assets or for personal use.

- Other deductible items such as depreciation and amortised borrowing costs are deducted to reduce your net profit to what is known as a taxable profit.

How to increase profit

If you are looking for ways to increase your profit, you need to focus your attention on the four profit-determining factors: price, volume, variable costs and fixed costs. You can focus on one or more of these factors in order to enact change.

Before taking any action, you should have a good look at your business and see which of these four profit-determining factors you need to focus on. Do not skip this step and jump into random actions like reducing your prices, spending money on advertising, reducing or increasing stock levels, until you have worked out which factor/s you need to focus on. If you cannot work this out yourself, or need a fresh set of eyes to consider your circumstances, a good accountant can help you.

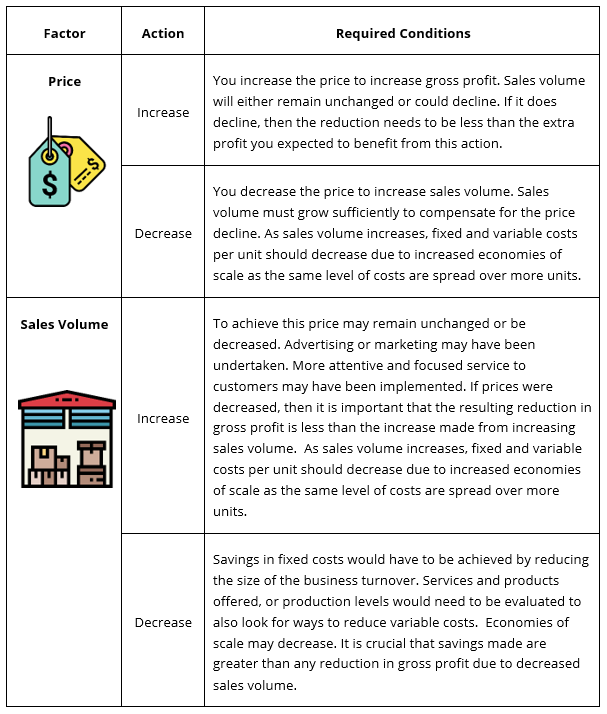

It is important to note that you can improve business profit by increasing or decreasing any of the four profit-determining factors; however, some conditions need to be met.

It can be seen from the above that action on any one of those four profit-determining factors can impact the other three factors. A profit improvement strategy will involve more than one factor and may result in an increase or decrease in each.

There is no standard formula for improving your profit. You need to look at your business’s strengths and weaknesses and tailor your strategy to your business circumstances. Too many people make the mistake of copying other business strategies that they consider successful without looking carefully at whether someone else’s fixes are right for their business.

Once you have decided what actions to take, the results of these actions need to be monitored regularly and carefully. If the profit improvement strategy is not working as planned, then adjustments need to be made quickly before damage is done.

In summary

- A favourable change in price and/or your variable costs improves your gross profit margin per dollar of sales.

- A favourable change in your sales volume and/or your fixed costs indicates greater productivity. Therefore, the overhead costs you incur in running your business involve lower costs per dollar of sales as a result of your profit improvement strategy.

Please feel free to reach out if you need help.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or professional advice from your accountants at KMT Partners.