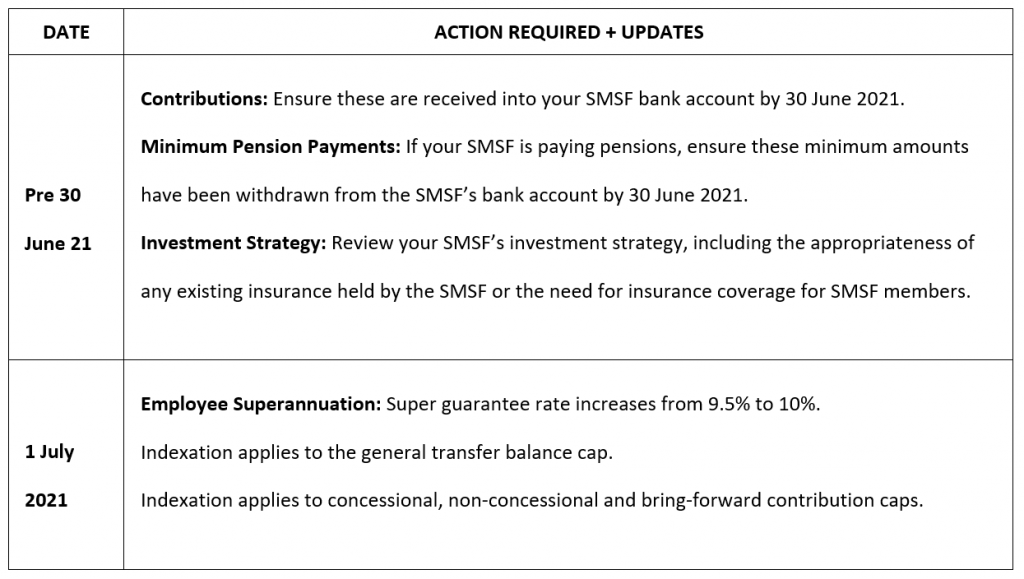

As a Trustee / Director of a Trustee Company for your Self Managed Superannuation Fund (SMSF), there are changes in opportunities and risk areas you need to consider each year.

So to keep you up to date with everything affecting your SMSF, we’ve outlined a brief summary of key dates and actions required, along with the key changes you should be aware of. Some of these reminders will help to minimise your tax, while others will reduce your exposure to an ATO tax audit.

Key changes you need to be aware of

Superannuation guarantee increases to 10%

From 1 July 2021, the Superannuation Guarantee rate increases from 9.5% to 10%. It is planned to increase by 0.5% each year until it reaches 12% on 1 July 2025.

If any SMSF members are paid on a “total remuneration” basis (a package inclusive of superannuation), this will mean that their take-home pay will reduce by 0.5% unless the employer decides to increase their total remuneration by 0.5%.

For SMSF members who are paid wages or salary plus superannuation, their take-home pay will remain the same, and the 0.5% increase will be added to their superannuation payments.

Contributions caps increase

From 1 July 2021, the superannuation contributions caps increase. This means you can contribute more to your SMSF, assuming you have not already reached your “transfer balance cap”.

The concessional contribution cap increases from $25,000 to $27,500. These contributions are tax-deductible contributions made from your employer or personal contributions.

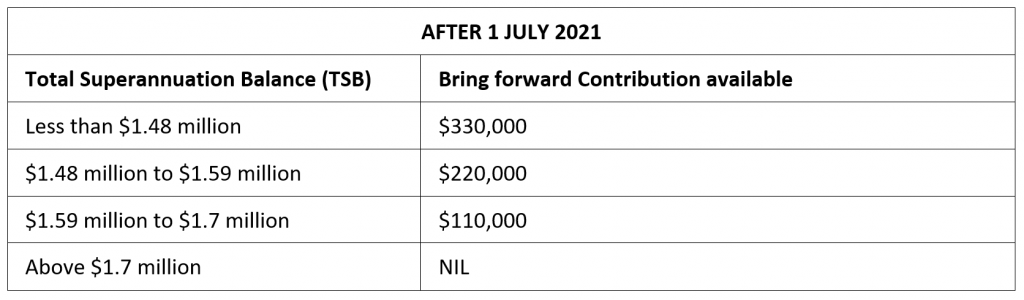

The non-concessional cap increases from $100,000 to $110,000. These contributions are not tax-deductible and are made from your after-tax funds.

The bring-forward rule allows individuals under the age of 65 to contribute up to 3 years’ worth of non-concessional contributions to super in one year. Please note that if you have used the bring-forward rule in 2019 or 2020, your contribution cap will not increase until the 3 year period has passed.

Transfer balance cap

The transfer balance cap began on 1 July 2017. It is a lifetime limit on the total amount of superannuation that can be transferred into retirement phase income streams, including most pensions and annuities.

Before 1 July 2021, all individuals have a personal transfer balance cap of $1.6 million. From 1 July 2021, all individuals have a personal transfer balance cap of between $1.6 million and $1.7 million. Individuals who start their first retirement phase income stream on or after 1 July 2021 will have a personal transfer balance cap of $1.7 million.

When the general transfer balance cap is indexed to $1.7 million, there won’t be a single cap that applies to all individuals. Every individual will have their own personal transfer balance cap of between $1.6 and $1.7 million, depending on their circumstances.

From July 2021, you are able to see your personal transfer balance cap in ATO online. This will be the only place you can see your personal transfer balance cap if you had a transfer balance account before 1 July 2021.

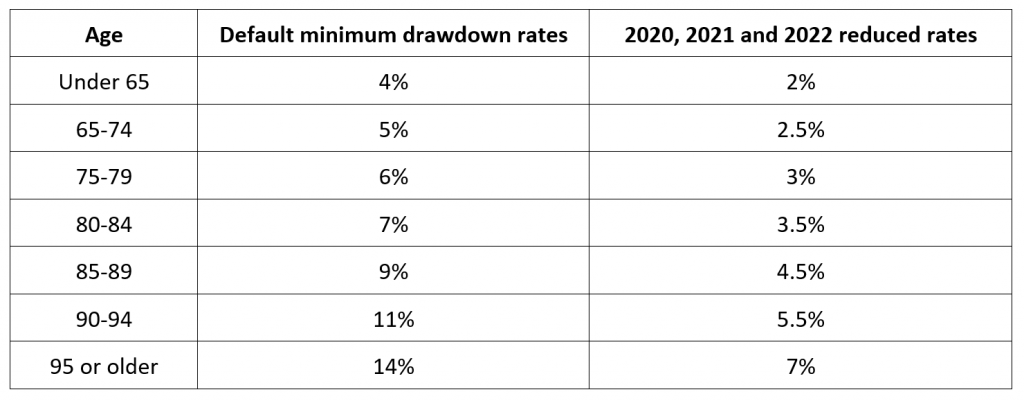

Minimum pension payments

The Federal Government temporarily halved minimum drawdown amounts in March 2020 in response to the COVID-19 pandemic. This was introduced to allow pension members to withdraw less of their retirement savings and keep a greater amount invested.

Recently, the Government has announced that the 50% minimum drawdown reduction for pension payments has been extended to 30 June 2022.

Your 2021-22 reminders & action items

ATO payment deferrals

We can liaise with the ATO and negotiate a deferral or repayment plan if you are having trouble paying any ATO liabilities. Please contact us immediately if you would like our assistance with this.

Contributions to super

If you want to claim a tax deduction for super contributions as an employer or individual, these payments must be received into your SMSF bank account by 30 June 2021.

Carried forward unused concessional contributions

From 2020 carry-forward rules allow you to make extra concessional contributions – above the general concessional contributions cap – without having to pay extra tax.

The carry-forward arrangements involve accessing unused concessional cap amounts from previous years. An unused cap amount occurred when the concessional contributions you made in a financial year were less than your general concessional contributions cap.

To use your unused cap amounts, you need to meet two conditions:

- Your total super balance at the end of 30 June of the previous financial year is less than $500,000.

- You made concessional contributions in the financial year that exceeded your general concessional contributions cap.

The amount of unused cap amounts you will be able to carry forward will depend on the amount you have contributed in previous years, starting from 2019. You can use caps from up to five previous financial years.

Please note that if your combined income and concessional contributions are above the Div 293 threshold of $250,000, then you may have to pay an additional 15% tax on these contributions.

Review your investment strategy

Your investment strategy is your plan for making, holding and realising assets consistent with your investment objectives and retirement goals. It should set out why and how you’ve chosen to invest your retirement benefits to meet these goals.

The superannuation laws require that you must prepare and implement an investment strategy for your self-managed super fund (SMSF), which you must then give effect to and review regularly.

Your investment strategy should not be a “set and forget” document. You should review your strategy regularly to ensure it continues to meet your members’ current and future needs depending on their personal circumstances.

Certain significant events should also prompt you to review your strategy, such as:

- A market correction

- When a new member joins the fund or departs a fund

- When a member commences receiving a pension. This is to ensure the fund has sufficient liquid assets and cash flow to meet minimum pension payments prior to 30 June each year.

You should also review your strategy at least annually and document that you have undertaken this review and any decisions made arising from the review. For example, you could do this as part of the annual trustee meeting minutes. You should then provide these minutes or other evidence of a review to your auditor. This will show that you’ve met the requirement to review regularly and, where necessary, revised your investment strategy.

Review insurance inside your SMSF

SMSF trustees need to consider the need for insurance cover for the fund members when creating and reviewing the fund’s investment strategy.

Please contact our licenced financial advisor if you need assistance in calculating appropriate insurance amounts for the members in your SMSF and how these insurances should be structured.

For further information and expert assistance with your SMSF, contact our KMT accountants today!

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or professional advice from a qualified accountant or financial adviser at KMT Partners.