Many Australians own properties in their individual names. These properties may have a large equity component (asset value greater than liability value). The property can be a family home or an investment property.

Creating an asset protection plan to minimise your risk is as important as building your wealth in the first place.

According to the Director of LightYear Group Grant Abbott, “Assets of any kind in your own name are exposed in a litigation action. The biggest threat is not the litigation, but the time taken in the legal system, the stress and the sheer amount of legal fees that can easily escalate in any litigation.”

One of the typical options to protect your equity is to transfer the property into an Asset Protection Trust. However, this will incur stamp duty and may trigger capital gains tax. The best solution is to transfer the equity value of the property to an Asset Protection Trust.

“The Protector” – sophisticated asset protection

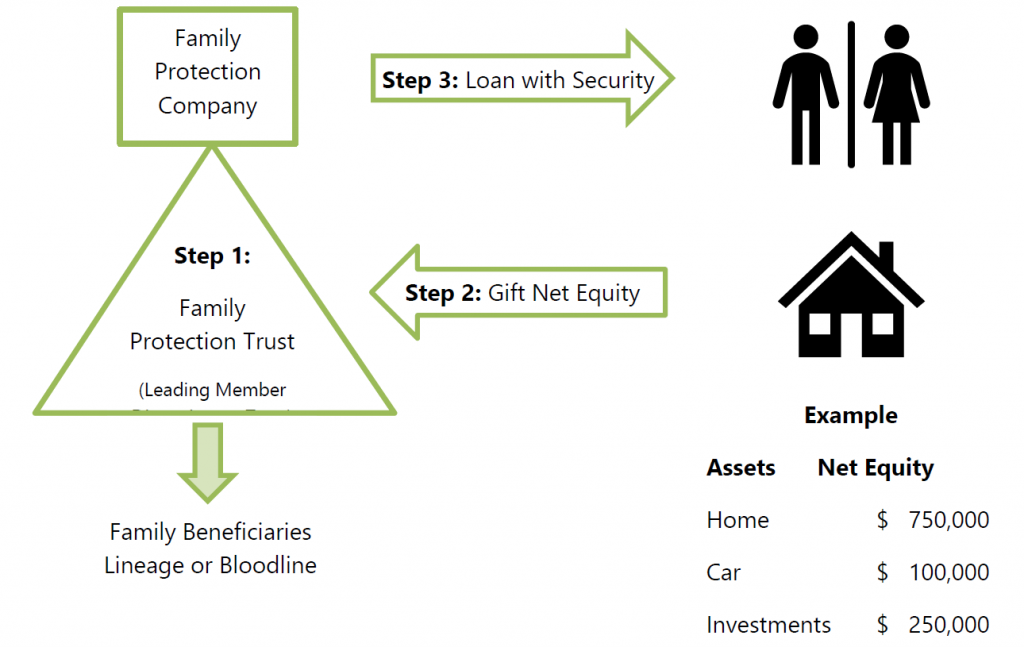

“The Protector” is an asset protection strategy, which provides both asset protection and ensures that your assets are held for the benefit of those beneficiaries in your lineage or bloodline that you want. This will ensure that your hard-earned assets are kept in the hands of your lineage.

“The Protector” involves the establishment of a special purpose Trust (a Leading Member Discretionary Trust) for the beneficiaries of your lineage or bloodline, including you and their spouse/partner. We refer to this as a “Family Protection Trust”. It is effectively your long-term wealth vault.

We do not recommend using any existing Trusts that you may have for the following reasons:

- They may be exposed to legal claims due to having run a business or provided services in the past; and

- They don’t have the Leading Member provisions in them to provide the highest level asset

Once the Family Protection Trust is established, you can document the transfer of the equity in your assets, including your family home, into the Trust and then document the lending of the same dollar amount back to you for your use. This means no tax or stamp duty issues that would be triggered from the actual transfer of assets, but more importantly, you receive vital protection of your assets.

Clawback periods under bankruptcy and insolvency

It is important to understand that strategies which are implemented to transfer assets at or immediately prior to insolvency are ineffective. It is too late to undertake asset protection strategies for you when creditors are “knocking at the door”.

Bankruptcy is the legal process where a bankruptcy trustee is appointed to administer an insolvent individual’s affairs.

Bankruptcy – Voidable Transactions

Trustees of bankrupt estates investigate pre-bankruptcy transactions when they suspect the transaction improperly transferred assets away from the bankrupt that would otherwise be available to creditors. The Bankruptcy Act 1966 will in some cases allow the voiding of these transactions and require the other party to return an asset, or make a payment, to the trustee.

What type of transactions may be voided?

The Bankruptcy Act enables the trustee to void:

- undervalued transactions (under section 120 of the Bankruptcy Act);

- transfers are done with the intention to defeat creditors (under section 121 of the Bankruptcy Act); and

- transfers where the consideration was paid to a third party (under section 121A of the Bankruptcy Act).

What are Undervalued Transactions?

Undervalued transactions are asset transfers at less than market value that is deemed “undervalued”. Sometimes a debtor will sell or transfer assets to third parties shortly before their bankruptcy and attempt to make the transaction look commercial. Undervalued transactions may take the form of the following:

- A sale for less than the asset’s market value – moving a valuable asset to another

- A purchase of something at a greater consideration than its value, thus moving money to another

A trustee can void property transfers (including) within five years before the bankruptcy’s commencement.

Are some transfers of assets protected?

Yes. The Bankruptcy Act protects some transfers from being voided when both of these conditions are present:

- The transfer occurred over two years prior to the bankruptcy’s commencement to an unrelated party, or the transfer occurred over four years prior to the bankruptcy’s commencement if the other party to the transaction is related to the bankrupt; and

- The debtor was solvent at the time of the transfer and remained solvent after the transaction.

Transactions undertaken with non-related parties while the debtor was solvent should be protected, as this would not be prejudicing creditors by transferring these assets. The transaction’s other party has the onus of proving that the bankrupt was solvent at the transaction time and remained solvent immediately thereafter.

Avoiding a Clawback

To reduce the risk that any transfers or gifts of assets could be voided and clawed back in the future, it is important to:

- Make these transfers or gifts as soon as possible so that the 4 year clawback period can start as soon as possible; and

- Clearly document your solvent asset position at the time that you make any transfers. This will make it much harder for anyone to accuse you of transferring your assets to defeat the payment of any creditors.

How “The Protector” works with properties

If you were to transfer any properties held in your personal name to a Family Protection Trust, you would incur stamp duty on the current property values and you would be assessed capital gains tax on any capital gain on investment properties.

Using “The Protector”, you can protect the value of your property assets without incurring stamp duty or triggering any capital gains tax payable.

There are 3 key steps:

- Establish a “Family Protection Trust” (a Leading Member Discretionary Trust with a Leading Member Company as Trustee).

- You gift your net equity in your chosen assets to your Family Protection

- Your Family Protection Trust provides an immediate loan back to you personally of the net equity amount and takes security over your personal assets (e.g. a registered mortgage over a property) to provide protection for the loan.

The end result is that your net equity in the assets that you choose is now held by their Family Protection Trust and is not in your personal name.

With little or no assets in your personal name, most lawyers would not bother trying to take legal action against you, because even if they win, you do not have any assets in your name that could be taken as a legal settlement.

Informing your bank

While in most States there is no requirement for the first mortgage holder to approve the registration of a second mortgage over a property, we believe that it shows courtesy to your bank funder to keep them informed about why you want to protect your home equity and lodge a second mortgage over your property.

Other CGT considerations

There are other issues that should be considered when implementing a gift and loan back strategy.

For example, where the asset is a private asset, then a business owner should consider whether eligibility for the small business concessions will be jeopardised. Generally, a family home and assets used solely for personal use and enjoyment are not taken into account in the $6million maximum net asset value test.

However, if a gift and loan back strategy is implemented in respect of the business owner’s home, and the resulting loan is secured with a mortgage or second mortgage, then:

- The Leading Member Discretionary Trust which holds the loan receivable will now have an asset that is not used for personal use and enjoyment; and

- The liability of the “risk-taker” individual or entity will not relate to a business asset but rather the family home, and therefore will not reduce the net assets for small business purposes of that entity.

How “The Protector” works with non-property assets

Once your Family Protection Trust has been established, you can also consider gifting other assets to it. Ideally, these assets should not have any loans or debt attached to them.

Examples of assets that you can transfer to your Family Protection Trust include:

- Cash

- Vehicles

- Boats

- Home Contents and Furniture

- Jewelry

- Collectables

Each of the above assets can be transferred to your Family Protection Trust by using a Deed of Gift.

Gifting the assets is important because it breaks the link between you and the asset. If you simply transfer the assets to your Trust without properly documenting the transfer as a Gift, then the value of the asset transferred would be viewed as a loan asset in your individual name, and this asset could be at risk if they were to be made bankrupt.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or seek tax advice from your accountants or financial advisers at KMT Partners.

Contact us today on 08 8431 0022 if you need help with asset protection

Reference: ChangeGPS, LighYear Docs