Do you have a Family Trust? Learn how to save tax with the following strategies.

Profit from a Trust?

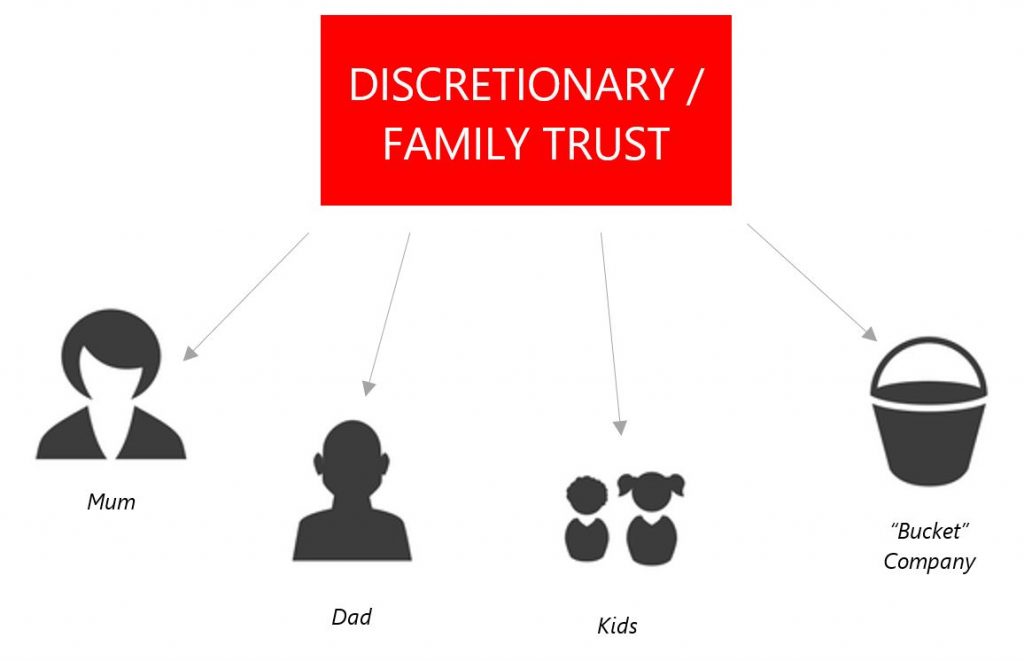

Using a “bucket company” can be a great strategy for saving tax on trust profits distributed. If you have a Discretionary or Family Trust that generates profits, this strategy may apply to you.

A “bucket company” is a company that is set up as a beneficiary to a trust, which allows you to “cap” the tax on profits distributed by a trust to 30% or 25%. This is much less than the individual top marginal rate of 47%!

Here’s how this works:

Assume a trust earns $250,000 in profits from business.

Option 1: Distribute profits 50 / 50 to Individuals 1 and 2. Total tax (inc. Medicare Levy) payable = $66,734 (26.7%)

Option 2: Distribute $90,000 each to Individuals 1 & 2 and distribute balance of $70,000 to a “bucket” company at a 25% tax rate. Total tax payable = $60,534 (24%). (Note: This strategy assumes that the $70,000 in cash is available to be distributed to a bucket company, otherwise what is known as a Div 7A Loan Agreement will need to be entered into and loan repayments made over a 7-year period.)

The VALUE of this strategy is $7,100 in TAX SAVED!

The cash in a “bucket company” can be used to invest in shares, property, or to lend to other entities at a specific interest rate.

Important: You need to discuss this with our KMT advisers BEFORE you do it. There are different tax laws that affect the use of this strategy, and whether your “bucket company” can use a tax rate of 30% or 25%.

Download Fact Sheet – Why use a bucket company

Family trust distributions

Income received by a family trust should be allocated amongst the various beneficiaries by 30 June each year and documented by way of resolution. The resolution should be made by 30 June to avoid any later dispute with the ATO as to whether the income was properly allocated by this date.

The exact requirements for allocating trust income are set out in the trust deed, and as each trust deed is different, it is vital that trustees are aware of the terms applying to that particular trust.

Also note that special rules apply to the “streaming” of capital gains and franked dividends received by family trusts to particular beneficiaries, and if you wish to stream, it is critical that there are sufficient “streaming” provisions in the family trust deed which allow the trustee to do so.

The ATO released a series of guidance documents outlining its views on the treatment of trust distributions made in certain situations (such as to adult children or retired parents who may not receive the benefits of the funds allocated to them) and the potential application of an anti-avoidance rule in Section 100A of the tax legislation which can have the effect of assessing the trustee at the top marginal tax rate of 47% instead of assessing the beneficiaries who were purportedly allocated the distributions.

Avoid extra tax with a trust distribution resolution

As explained above, you need to complete your trust distribution resolutions before 30 June to avoid paying extra tax of up to 47% of Trust profits.

Under the Family Trusts Laws:

If a Trustee of a Trust fails to make a resolution to distribute the income of the Trust before the end of the financial year, the Trustee may be assessed by the Australian Taxation Office (ATO) on the Trust income at the highest marginal tax rate of 47%, rather than the intended beneficiaries being taxed at generally much lower tax rates.

Contact us today on 08 8431 0022. The sooner we start preparing your Trust Distribution Resolutions, the sooner we can implement strategies to help minimise your tax.

About our advisers:

Michael Fox has been dedicated to the success of his clients, devising comprehensive wealth strategies for both personal and business growth for over 4 decades. With extensive expertise in business governance and family business succession, Michael specialises in empowering emerging businesses and family enterprises by fostering renewal, enhancing value and smooth transitions to the next generation. Please do not hesitate to reach out if you need assistance.

Chrisanthe Lekatis is renowned for her expertise in management accounting, virtual CFO services, and top-tier business advice. She empowers management with tailored strategies for success, streamlining processes to achieve efficient and cost-effective outcomes. Her commitment to building trust and lasting relationships goes beyond professional excellence; it’s a personal ethos. By actively listening and understanding her clients’ businesses and goals, Chrisanthe thrives on collaborative efforts to navigate challenges and collectively achieve their aspirations. Please do not hesitate to reach out if you need assistance.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or seek tax advice from a qualified accountant or licensed financial adviser at KMT Partners. Information is current at the date of issue and may change.