Many small to medium businesses are advised to have a family member as the operator (Director) of the business and risk-taker associated with the company whilst your partner or a family trust or similar hold all assets for the family.

This commercial advice is based on an asset protection strategy and widely adopted across the country.

Whilst the “trading risk” has been isolated from being vulnerable to commercial adverse consequences, the solution does not deal with the vulnerability of the sole director to death or disability.

Yes, financial planners suggest an economical solution of keyman insurance or similar. However, this is only a partial solution to an individual’s vulnerability solely dealing with economic consequences.

Do you own a business and act as the sole director?

As a sole director, if you suffer a medical issue, who will act as the company director?

Suppose a company director is incapacitated, or they die without a properly drafted Will and company Resolutions. In that case, their business may not operate, and their staff may end up not being paid. This event could have disastrous effects on their business value.

One traditional solution is an alternate director; however, again, this is a partial solution.

A successor director is a person appointed by a director if they cannot carry out their duties as a director due to divorce, is incapacitated or die to ensure the smooth succession to a director’s role.

Having a nominated successor director is vital for Asset Protection and Estate Planning in family and private companies.

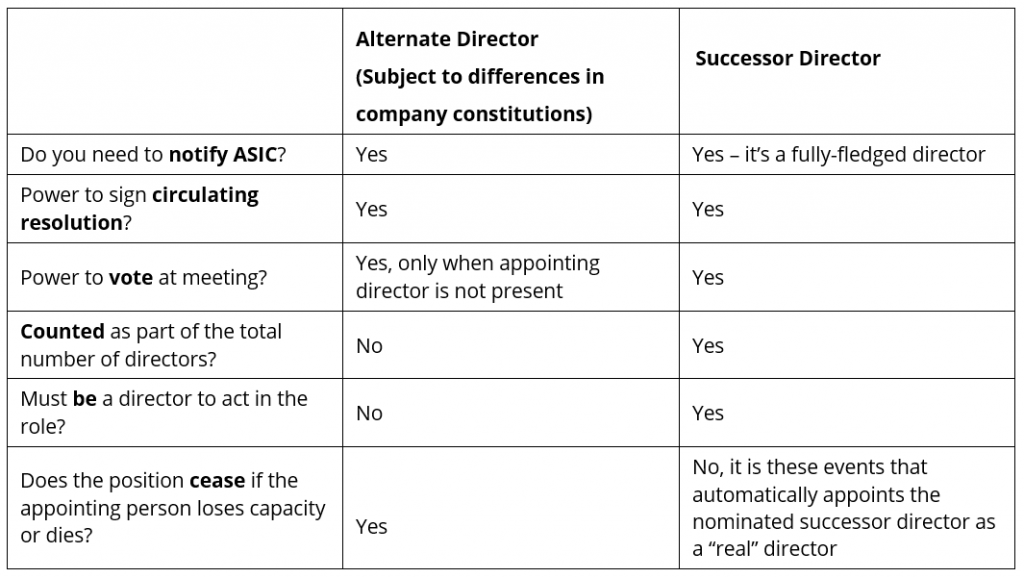

What is the difference between a Successor Director and an Alternate Director?

Very simply, a Successor Director is a much better solution than using an Alternate Director.

Protect the control of your companies with a Successor Director

If you are the sole director of any company, it’s important to put documents into place now to nominate your successor director to ensure the protection of control over the assets in all your companies and your trusts which have trustee companies, and your family can maintain control of these companies.

KMT Partners is the only Chartered Accounting Firm in Adelaide with a specialist focus on autonomy – supporting the decision making of individuals, families, businesses and the aged. Our team work closely with you to generate sustainable growth, create financial independence across generation and support the intergenerational transition.

Please reach out if you wish to understand the problems and evaluate solutions. Contact Michael on 0417 826 863 or email michael@kmtpartners.com.au

The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice.