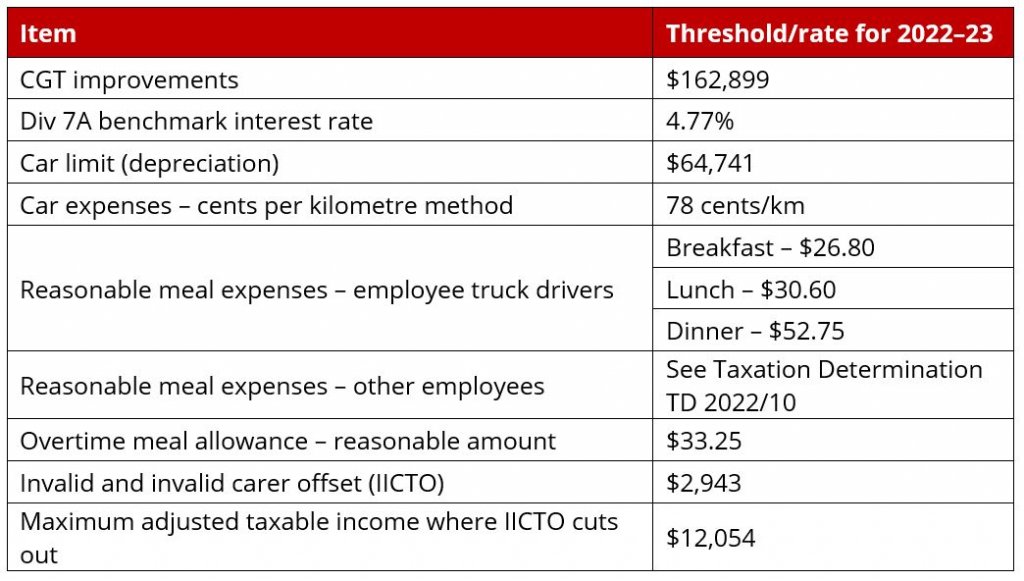

Various income tax threshold amounts and rates increased for the 2022–23 income year.

These are listed below:

Low and Middle-Income tax offset

Don’t forget that the Low- and Middle-Income tax offset (LMITO) is no longer available from the current income year (2022–23). The income year just ended (2021–22) was the last year for which LMITO was available, and the maximum amount was increased by $420 to $1,500. The maximum amount is available where the individual’s taxable income ranges between $48,001 and $90,000 (inclusive). Above $90,000, the LMITO phases out at the rate of 3 cents in the dollar until taxable income reaches $125,000.

There is no need to claim this offset in your income tax return. The ATO applies it automatically to eligible taxpayers. Note that the LMITO is available only to reduce the amount of an individual’s income tax liability. It is not a refundable amount and cannot be used to reduce any Medicare levy payable.

Superannuation changes

A number of superannuation changes took effect on 1 July 2022, including:

- Employees earning less than $450 a month are now entitled to superannuation guarantee support from their employers;

- The rate of superannuation guarantee increased from 10% to 10.5%;

- The work test for non-concessional and salary sacrificed super contributions for persons aged 67–74 years has been removed (the work test still applies for those aged 67–74 years claiming a deduction for personal super contributions);

- The bring forward rule for non-concessional contributions has been extended to persons aged 67–74 years;

- The eligibility age for making downsizer contributions has been reduced from 65 to 60 years;

- The maximum amount of voluntary superannuation contributions that can be released under the First Home Super Saver Scheme has been increased from $30,000 to $50,000.

COVID-19 early release of superannuation

If you accessed your superannuation early in response to the COVID-19 pandemic, you can choose to re-contribute those amounts by 30 June 2030 without them counting towards your non-concessional contributions cap. The choice must be made in the approved form and given to your superannuation fund before you make the re-contribution.

Superannuation accessed early is tax-free (treated as non-assessable non-exempt income).

Business tax changes

A number of income tax changes relevant to businesses took effect from 1 July 2022, including:

- Temporary full expensing (allows an immediate deduction for the cost of a depreciating asset) was extended by 12 months to 30 June 2023;

- The loss carry-back (allows companies to carry tax losses back as far as the 2018–19 income year) was extended by 12 months to 30 June 2023;

- The cessation of employment as a taxing point for ESS interests that are subject to deferred taxation was removed

GDP adjustment for 2022–23

The GST and PAYG instalment amounts are usually adjusted every year by the ‘GDP adjustment factor. This is either calculated on the basis of changes in the GDP (gross domestic product) over a 2-year period or is a percentage set by law.

For 2020–21 and 2021–22, the GDP adjustment factor was reduced by legislative amendment to nil. For 2022–23, the GDP adjustment factor has been reduced by legislative amendment to 2% (instead of the usual 10% uplift).

Contact our KMT tax adviser to find out about any changes that might affect your business.

FBT exemption for electric vehicles

Legislation has been introduced into Parliament that will provide a fringe benefits tax (FBT) exemption for electric and other low emission cars used by employees for private use.

To be eligible for this FBT exemption:

- The car must be a ‘zero or low emissions’ car – for example, a battery electric vehicle, a hydrogen fuel cell electric vehicle or a plug-in hybrid electric vehicle; and

- The value of the car at the first retail sale must be below the luxury car tax threshold for fuel-efficient cars ($84,916 for 2022–23).

A car that has an internal combustion engine will not be eligible for the FBT exemption unless it is able to be fuelled by a battery that can be recharged by an off-vehicle power source (i.e. a plug-in hybrid car).

The FBT exemption will apply to fringe benefits provided on or after 1 July 2022 for eligible electric cars (including second-hand ones) first held and used on or after 1 July 2022. The operation of the amendment will be reviewed after three years in light of electric car takeup.

Corporate tax transparency – resident private companies

The corporate tax transparency income threshold for Australian-owned resident private companies has been reduced from $200 million to $100 million.

Each year, the ATO is required to publish corporate tax transparency reports which contain information reported by large corporations. The corporate tax transparency population refers to the entities that are included in the reports.

From the 2022–23 income year onwards, the ATO will include in its corporate tax transparency reports, information reported by Australian-owned resident private companies with an income of $100 million or more.

For further information and expert assistance with your tax, contact our KMT accountants today!

Check out KMT Free Resources to download tax guides and deductible checklist.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or professional advice from a qualified accountant at KMT Partners.