In today’s complex and fast-paced business landscape, the significance of good governance cannot be overstated.

Effective governance serves as the compass that guides companies towards long-term success, ensuring strategic goals are achieved while satisfying the diverse needs of stakeholders. In this article, we will explore why good governance is a cornerstone for business continuity, fostering trust and stability in the face of constant change.

What is business governance?

Business governance refers to the process of structuring, operating, and controlling a company with the aim of achieving long-term strategic goals for various stakeholders, including shareholders, creditors, employees, customers, and suppliers.

The primary objective of business governance is to realize the company’s desired vision and purpose by effectively attaining operational results and outcomes.

Why is good governance so important?

Good governance holds immense importance for businesses due to several reasons:

- Sustained operations: Good governance enables a business to maintain its operational continuity, ensuring that shareholders continue to invest capital and time into the company.

- Access to funding: Sound governance practices instill confidence in funders, facilitating ongoing financial support and investment in the business.

- Stable business environment: Suppliers are more likely to provide products and extend credit to a company with robust governance practices, as it signifies a stable and reliable business environment.

- Regulatory compliance: Compliance with regulatory requirements is crucial for business continuity, and effective governance ensures that a company meets all necessary compliance standards.

- Customer support: Good governance fosters customer trust and loyalty, encouraging continued support through product purchases and brand advocacy.

- Employee commitment: A well-governed business inspires confidence and faith among employees, ensuring their continued dedication and provision of quality services.

How big does a company need to be to benefit from a governance process?

Contrary to common belief, effective governance is beneficial for companies of all sizes, including smaller ones. As Richard Branson famously stated, “A big business starts small.” While smaller businesses often have more ad-hoc and relaxed governance practices, larger companies can sometimes become overly bureaucratic and arrogant.

For businesses, regardless of size, the ideal governance framework encompasses the following principles:

- Inclusion of necessary elements, without unnecessary complexities.

- A passionate and professional approach, coupled with personal humility.

- Consensus building, while avoiding the pitfalls of “groupthink.”

Governing vs managing a business

Governance and management represent distinct aspects of running a business:

Governance:

- Focuses on strategic matters.

- Involves determining the company’s purpose, vision, and strategies to achieve them.

- Accountable to shareholders and the company as a whole.

- Primarily concerned with monitoring the company’s current state, future direction, and necessary actions to achieve success.

Management:

- Concentrates on operational and tactical aspects.

- Implements the strategies devised by the governance team.

- Accountable to the board of directors.

- Ensures alignment with goals, tracks performance, and manages the day-to-day operations.

Learn more about the difference between business governance and managing

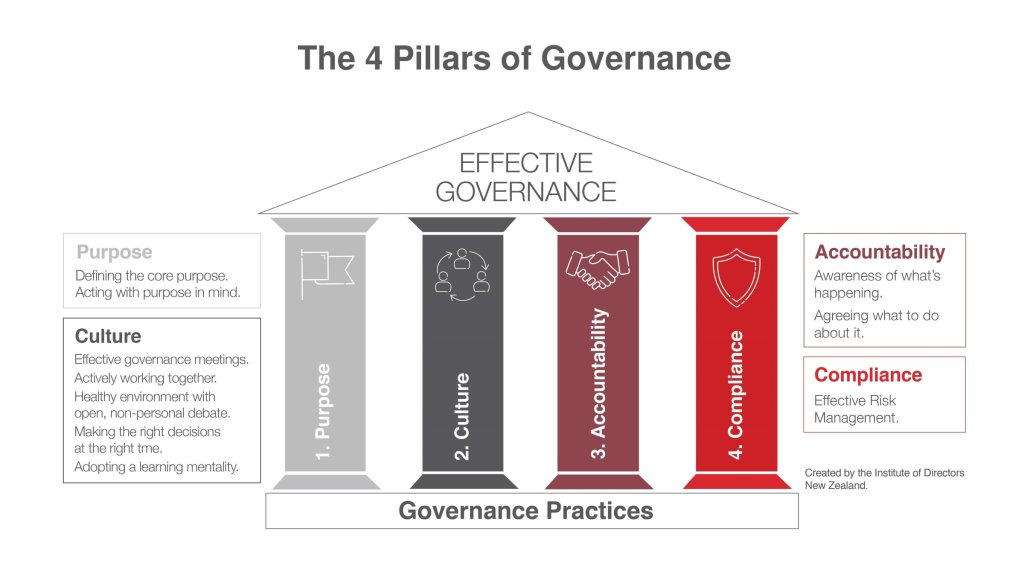

The four pillars of governance

- Purpose: A value-adding Board takes the lead in exploring, developing, and endorsing the company’s purpose, goals, and strategies required to accomplish those goals.

- Culture: A value-adding Board operates as a cohesive team, effectively addressing pertinent issues at the right time and in the appropriate manner. It fosters a high-performance culture that embraces constructive challenge, dissent, commitment, candour, and trust.

- Accountability: A value-adding Board diligently and continuously holds management accountable through well-informed, astute, effective, and professional oversight. It does not assume management responsibilities but ensures that management comprehends the company’s purpose and strategy, implementing them through a clear plan, resource allocation, task assignment, and performance management.

- Compliance: A value-adding Board ensures the company’s solvency and upholds compliance by relying on accurate financial reporting. It proactively identifies and mitigates organisational risks to maintain long-term stability and sustainability.

Speak with our trusted KMT advisers to develop your Governance Plan and implement best practices.

About our adviser: Michael Fox has been dedicated to the success of his clients, devising comprehensive wealth strategies for both personal and business growth for over 4 decades. With extensive expertise in business governance and family business succession, Michael specialises in empowering emerging businesses and family enterprises by fostering renewal, enhancing value and smooth transitions to the next generation. Please do not hesitate to reach out if you need assistance with governance planning.

Learn more about how we can help with Governance Planning services.

This is general advice only and does not take into account your financial circumstances, needs and objectives. The article should not be relied upon as specific information or advice without obtaining appropriate professional advice after a detailed examination of your particular situation from a qualified KMT adviser.